Austin Real Estate Market Analysis - February 15, 2024

by: Team Price Real Estate, Unmatched Agents, Unrivaled Insights

Published on: Thursday, February 15, 2024 at 1:15pm

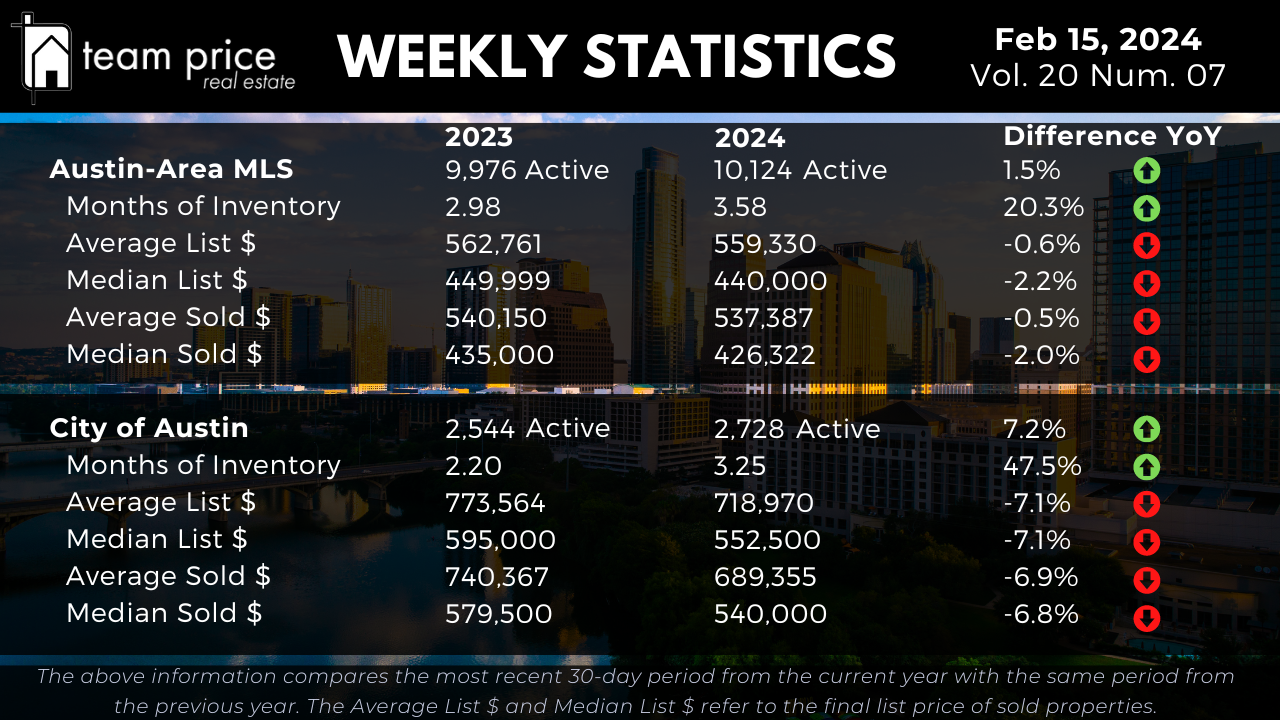

Updated Market Overview : The real estate landscape in the Austin area continues to evolve, reflecting shifts in supply and demand dynamics. Comparing data from last year to the present, there's been a modest increase in the total number of active listings within the Austin-Area MLS, rising from 9,976 to 10,124 properties, marking a 1.5% uptick. However, the Months of Inventory has also seen a notable increase, climbing from 2.98 months to 3.58 months, indicating a 20.3% rise. These figures suggest a slight adjustment in the market balance, with a slightly higher inventory level compared to the previous year.

Pricing Dynamics in Austin Real Estate : Across the board, pricing trends in Austin real estate have experienced slight fluctuations. The average active listing price in the Austin-Area MLS has seen a marginal decrease of 0.6%, settling at $562,761, while the median active listing price has dipped by 2.2% to $449,999. Similarly, the average sold property prices have experienced a slight downturn, with a 0.5% decrease to $537,387, and a 2.0% decrease in the median sold price to $426,322. These adjustments reflect the nuanced nature of the market, with pricing recalibrating in response to various factors influencing buyer and seller behavior.

City and Regional Dynamics : Within the City of Austin, there has been a notable increase in total sales, rising by 7.2% from 2,544 to 2,728 properties, indicating continued demand within the urban core. However, the Months of Inventory has also seen a significant jump of 47.5%, from 2.20 months to 3.25 months, suggesting a shift in the balance between supply and demand. Additionally, both the average and median active listing prices in Austin have experienced declines of 7.1% and 7.1%, respectively, further reflecting adjustments in pricing dynamics within the city.

Central Texas Cities and Zip Code Analysis : Analyzing data from Central Texas cities and zip codes reveals localized variations in market conditions. In terms of month-over-month price changes, 47% of cities and 47% of zip codes reported increases, while 53% of cities and 51% of zip codes experienced decreases. Looking at year-over-year data, 43% of cities and 37% of zip codes witnessed price increases, with the remaining experiencing declines. These findings highlight the heterogeneous nature of the real estate market across different areas within Central Texas.

Sales vs. List Price Analysis : The current sales-to-list price ratio stands at 96.93%, indicating a market where buyers often negotiate prices below initial listings. Among properties sold this month, the majority, or 70.57%, sold under the list price, while 18.86% sold at the list price, and 10.57% sold over the list price. These figures reflect the negotiation dynamics between buyers and sellers in the current market environment.

Peak Value Analysis: Austin-Area MLS : Reflecting on peak values over the past 12 months, several key metrics have experienced declines. From their respective peaks, the average list price decreased by 5.36%, the median list price decreased by 12.02%, the average sold price decreased by 16.97%, the median sold price decreased by 16.59%, the average sold price per square foot decreased by 18.52%, and the median sold price per square foot decreased by 16.79%.

Peak Value Analysis: City of Austin : Similarly, analyzing peak values within the City of Austin reveals declines across various metrics. From their respective peaks, the average list price decreased by 4.09%, the median list price decreased by 10.41%, the average sold price decreased by 21.62%, the median sold price decreased by 23.72%, the average sold price per square foot decreased by 26.24%, and the median sold price per square foot decreased by 25.70%. These figures underscore the broader market trends and adjustments in property values within the city limits.

The following report, with over 570 pages, dives deep into every facet of the Austin real estate market, focusing on market cycles, affordability, and interest rates, providing essential insights for informed decision-making. Team Price Real Estate, with its expertise and data-driven approach, continues to uphold its commitment to "Where Experience Meets Insight," delivering exceptional service in the Austin real estate market.